The recent devastation created by the earthquake and subsequent tsunami, and its effect on the already battered economy and self esteem of Japan is hard to watch. The damage will take years to unravel, and the rapidly aging population may simply lack the energy and will to see through to the end the immense effort required to restore the foundations of a flourishing economy. The damage created by the natural disaster was severe, but certainly not the index blow. Japan has been under several decades of misdirected investment and Keynesian philosophy that left it wide open to the final blow of that cascading wave of water. A clear example of what not to do to a vibrant economic process is present for all to see, but the current caretakers of the American economy seem to have paid the lessons no heed and, in an unconscionable way appear determined to repeat Japan’s mis-steps on an ever more massive scale.

The troubles for Japan in the late 1980’s were set into motion at the very point at which the Japanese economic miracle was being heralded as an unstoppable force and the successor to post world war America’s place as the world’s pre-eminent world economic power. Article after article heralded Japan’s example as one America would do best to emulate or face has been status. This was smart capitalism, with government support of fledgling industries, cradle to grave guarantees to the worker who gave his life long loyalties to his company, and teamwork and equal credit and reward instead of entrepreneurial incentive and unequal outcomes. The Japanese behemoth had become the second largest economy in the world, and was rapidly closing on the largest, with a combination of creative industrial efficiencies and the outsourcing of mundane work and production to the little Asian Tigers of Korea, Thailand, Malaysia, and even China. The United States with its reliance on individual work ethic, nasty competition, market self corrections, and unequal reward seemed terribly outdated.

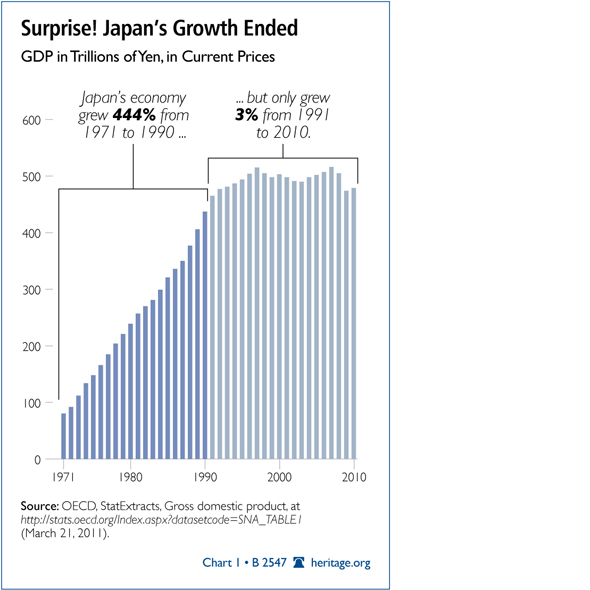

The parallels with cresting Japan of 1990 and our own current direction is ominously similar. The problem began with the bursting of a grossly over inflated real estate bubble in Japan, and the intolerable strain on the banking industry leading to bank default under the pressures of abandoned or intolerable loans. The result was a deep recession which brought the government to fore in its presumed role as Japan’s guarantor of success. The political elites in Japan determined the way out of the crisis was a sustained enormous stimulus, with the heaviest injection into Japan’s infrastructure – roads, bridges, planes, and trains. Japan’s debt rapidly ballooned as “investments” progressively lost their targeted appearance and politicians eager to please their constituents provided the funds for airports with no passengers, bridges with no traffic, trains with no economic basis, and roads to nowhere. The Japanese government dumped over 2 trillion dollars between 1991 and 1995 on government targeting projects with little rationalization for their need or their success. The result to the Japanese economic recovery of that enormous public investment – just about nothing. The hidden result was the majority of investment went to rural areas and local construction companies, with almost no connectivity to product, and an inverse effect on private enterprise by driving out private investors. It seemed the government proved absolutely incapable of “predicting” economic winners, settling for political rather than economic considerations. The result of all the spending? An incredible debt accumulation 180% of Japan’s gross domestic product and a two decade stagnation of the economic miracle, with an economic growth of only 3% of GDP over the twenty years of 1991-2010 compared to 444% growth from the previous twenty years of 1971-1990.

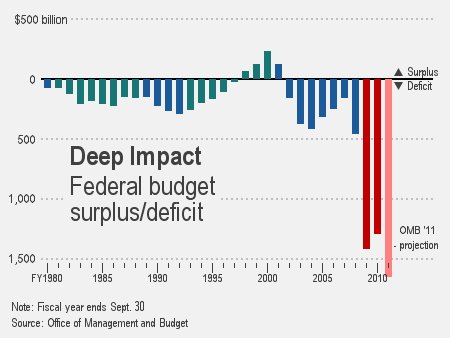

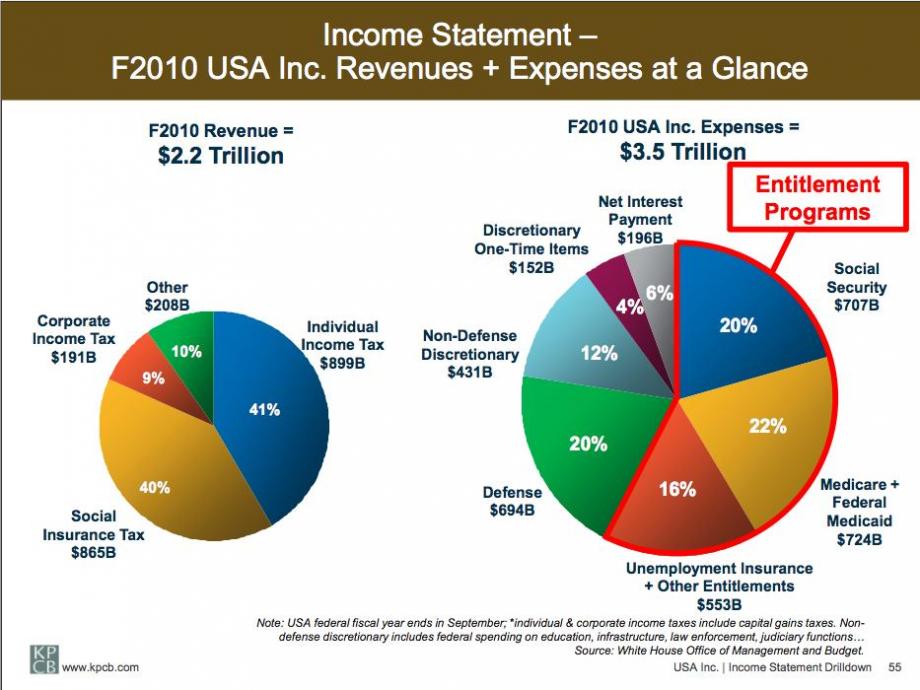

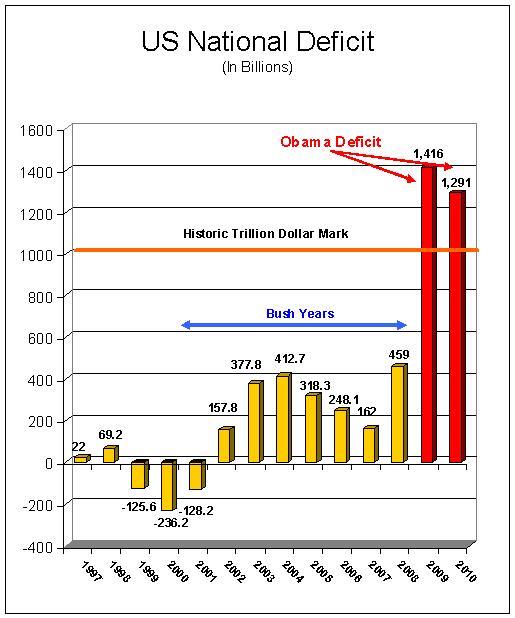

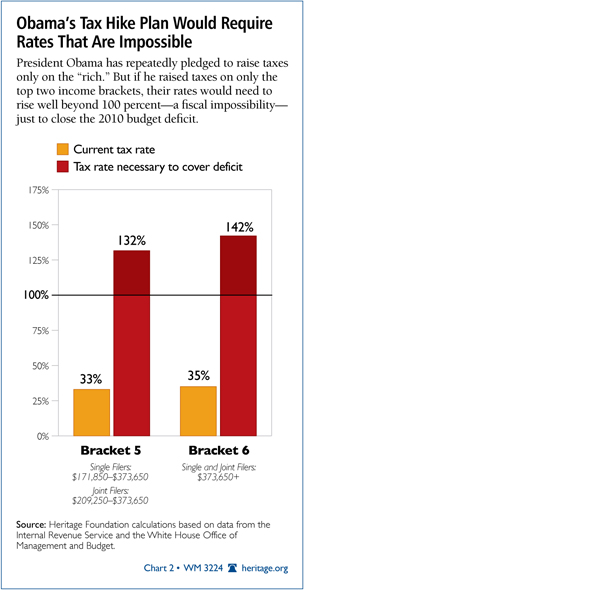

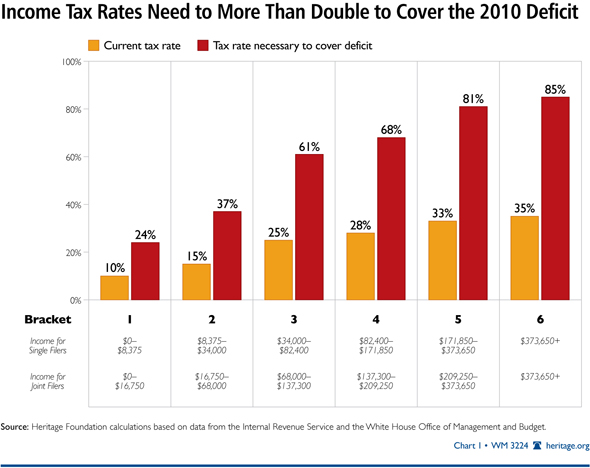

A fascinating article, in of all places the New York Times, was published in 2009 was written by Martin Fackler at the time the Obama stimulus was put forth, reviewing the history of the Japanese experience, and mentioning the republican party’s concern that utilizing governmental stimulus rather than unshackiling private enterprise could lead to similar results. The warning was telling – over 3.6 trillion dollars of debt spending stimulus to deal with the presumed crisis of a mortgage bubble over the last two and one half years has resulted in net job losses, cascading debt, targeted investment in non-market supported industries, and stagnant economic recovery with the risk of a double dip recession looming. The reaction of the government and Keynesian supporters such as Paul Krugman ? The stimulus may not have been “large enough”, trains and windmills will save the day, and taxing the rich appropriately will pay for the burgeoning investments. A close look at the tax totality puts the premise to shame.

History tells us that mistakes are repeated, not by ignorance of the past, but in willful disregard of the lessons learned. Once again a mighty economy is being progressively brought to its knees by a government that thinks it knows better, and can be fairer than natural forces in correcting inequities. It is embarrassing that intellectuals continue to fall for this loser of an economic philosophy that has done more damage to the average individual than any army of vicious capitalist roaders. The public is slow to understand, but understand they must. Leaders that recognize human nature, not those who rail against it, are a priceless value, that continues to be under-appreciated. It seems it takes a village to wreck what every individual in the village struggled so hard to build. Pick your leaders carefully in the coming months, or we will soon have the chance to look up in a few years and wonder what the tsunami was that hit us.